'We are the world’s biggest land-based salmon producer'

1,100 gutted weight tonnes was enough for Norwegian producer to take the crown last year

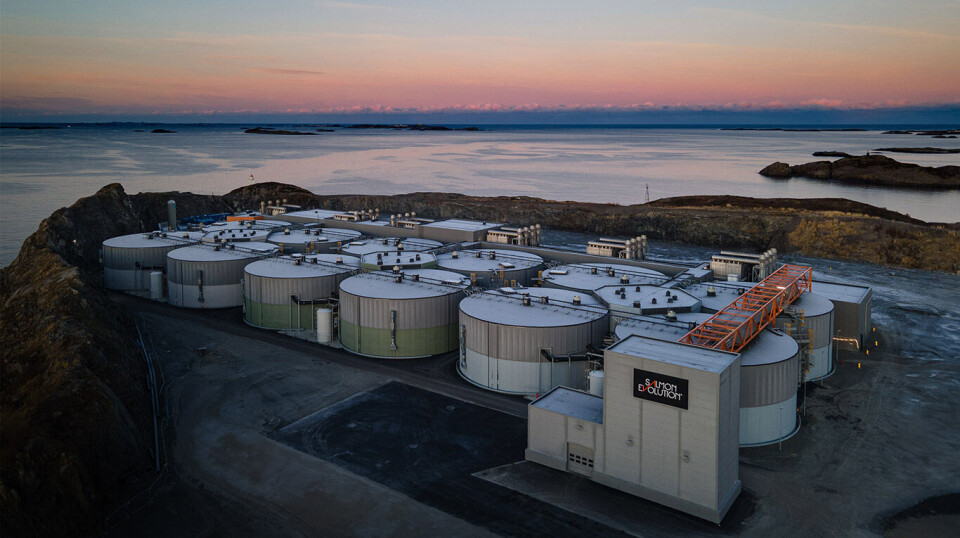

Salmon Evolution believes it is now the world’s largest land-based salmon farmer after harvesting around 1,900 gutted weight tonnes last year and remaining on track for big increase in 2024.

Significantly, 1,100 gwt of that volume was harvested in the fourth quarter when some of the company’s initial batches of smolts reached harvest size and Salmon Evolution progressed to what chief executive Trond Håkon Schaug-Pettersen said is a fully operational stage.

Successive stockings of smolts have been made since early last year to fully utilise the 7,800 gwt per year capacity of phase 1 of the company’s hybrid flow-through/recirculation facility at Indre Harøy, Norway, so production is picking up pace this year.

Inflationary pressure

A second phase of 7,800 gwt is planned at Indre Harøy and groundworks initial groundworks were completed last year. But the company has been working to nail down a price for the build before progressing further.

“Although phase 2 will benefit from the substantial infrastructure investments taken in phase 1, the company is seeing inflationary pressure on capital expenditure (capex),” Salmon Evolution wrote in its annual report.

It added that the project is subject to final investment decision upon completion of the initial project phase, expected in Q2 2024. Construction is planned to start shortly thereafter. “Capex the first 6-9 months is expected to be relatively moderate,” said the company.

£9.6m operating loss

Salmon Evolution made an operating loss of NOK -130.7 million (£9.6m) last year as it spent money on building biomass. Standing biomass increased from 733 tonnes live weight at the end of 2022 to 2,204 tonnes at the end of 2023. Net growth increased from 1,087 tonnes LW in 2022 to 3,751 tonnes LW.

The company’s stock market value fell slightly from NOK 2.859 billion in 2022 to NOK 2.806bn.

In his introduction to the annual report, Schaug-Pettersen said the rising production cost and other challenges facing the conventional salmon farming industry had significantly improved the relative competitiveness of land-based fish farming “which we now see at parity level with the conventional industry”.

“Looking forward we believe this trend will continue, given the unique opportunities you have in a land-based facility to control and optimise the environment,” added the CEO.

“Salmon Evolution is uniquely positioned to continue to lead the development in this industry. We are now at a fully operational stage and with the strong salmon market outlook, we are very well positioned to capitalise on this and demonstrate the profitability of our business case.”

3-5% mortality

In the report, Salmon Evolution says that by optimising water quality parameters with ideal and stable temperatures, it can reduce the time to harvesting for each batch from approximately 16 to 11 months with a 130g smolt insert weight, enabling greater production efficiency and optimal utilisation of its licensed volume.

The company estimates a mortality level of 3-5% at full run rate in phase 1, with stocking density in tanks varying from 7 kilos per cubic metre to a maximum of 85 kg/m³.

Since 2021 Salmon Evolution has had a strategic feed partnership with Cargill, which owns 2.3% of the company and has committed to allocate significant resources and R&D capacity to develop sustainable feed tailored to Salmon Evolution’s operational targets.

“Having the best possible feed is essential for every salmon farmer. Particularly, in our HFS system where we create optimal and stable living conditions for the salmon, we see a strong and untapped potential in tailoring a feed focused on maximising biological performance and product quality,” said Schaug-Pettersen.