Mowi chief highlights volume growth and post-smolt policy

The global salmon producer grew more fish than ever last year and is targeting half a billion tonnes in 2024

Mowi chief executive Ivan Vindheim highlighted the strong volume growth of the company since 2018 and the importance of post-smolts for the future as he announced record-high revenues for the fourth quarter of 2023 and the full year.

The Norway-headquartered global salmon farmer recorded revenues of €1.43 billion (£1.22bn) in Q4, up by 5% from the €1.36bn earned in the same quarter in 2022.

Operating profit in Q4 2023 was €203 million, down 15% compared to the €238.9m made in Q4 2022.

Revenues for 2023 were €5.513bn, an increase of 11% over 2022, and operating profit (operational EBIT) for the year was a record €1.028bn, a 2% increase over 2022.

Mowi is the world’s biggest Atlantic salmon farmer, with operations in Norway, Chile, Scotland, Ireland, the Faroes, Iceland, and Canada.

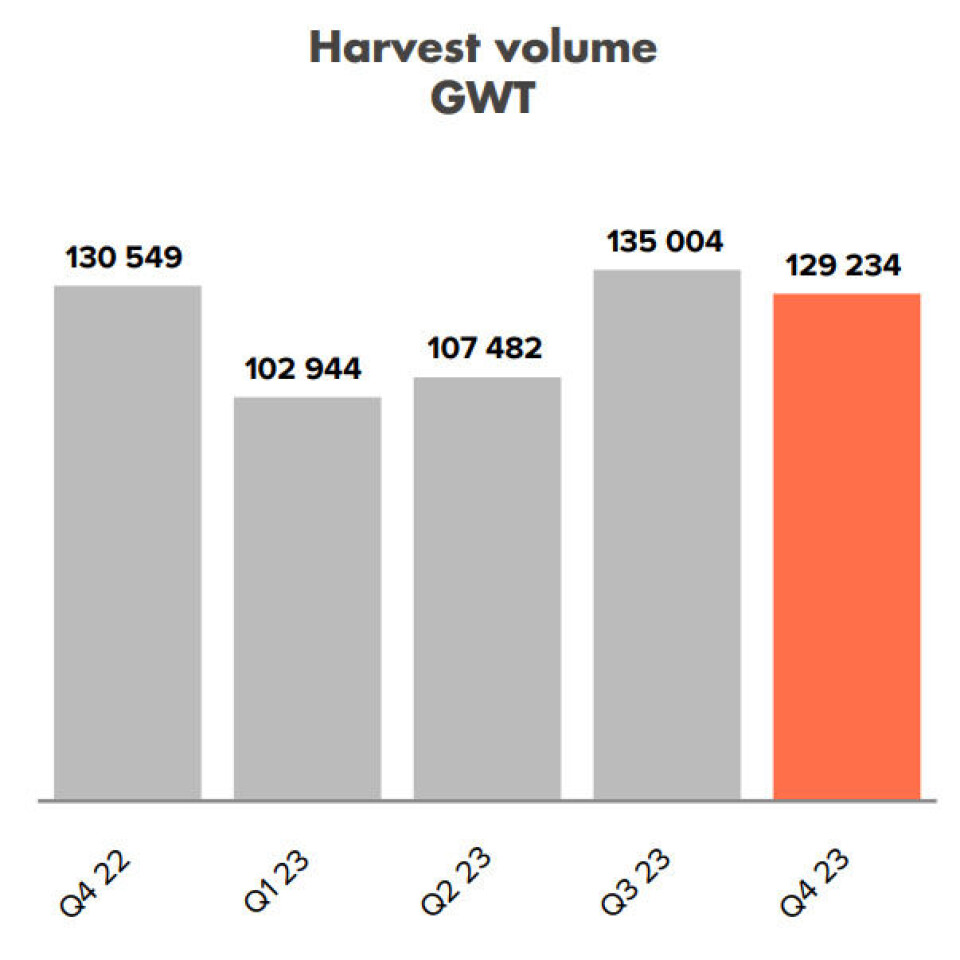

Its harvest volume in 2023 was a record 475,000 gutted weight tonnes. This year, the company intends to harvest 500,000 gwt.

“As recently as 2018, harvest volumes were 375,000 tonnes, hence we will have grown our farming volumes by as much as 125,000 tonnes by 2024,” said Vindheim.

“This is equivalent to annual growth of 4.9% versus a projected growth rate for the industry of 2.9%. This is mainly organic growth, and Mowi still has further organic growth initiatives that are expected to contribute to additional volume growth, of which the most important one is perhaps the post-smolt programme we launched at our Capital Markets Day in 2021.”

40 million post-smolts

By the end of 2024 Mowi’s post-smolt capacity will be almost 40 million post-smolt, equivalent to approximately 25% of the group’s total smolts. In Norway, the company has started operating a 3,300-tonne post-smolt facility in its southern region, is currently commissioning a 4,100-tonne facility in its mid-Norway region and will have a 3,300-tonne facility in its western region ready for use in Q4 2024. It will also produce post-smolts at two sites with floating semi-closed containment systems.

Mowi said its post-smolt share in Norway will be approximately 50% when the “naturally more resilient Region North” is excluded from the equation.

“This is expected to drive licence utilisation higher and improve Mowi’s sustainability credentials yet further through shorter production time in sea and improved survival rate,” said the company.

Consumer Products

Mowi said its Consumer Products division, which includes a factory in Rosyth in Fife, Scotland, had another solid quarter and an outstanding 2023, again setting operational and financial records on strong consumer demand. Operational profit of €152m and volumes of 232,000 tonnes product weight in 2023 were both new records for the group.

“These are impressive results, and I think it is fair to say that Consumer Products’ relentless focus on operational excellence over the past few years has really started to pay off,” Vindheim said.

Mowi said its feed division, which includes a feed mill at Kyleakin, Skye, Scotland, delivered a good fourth quarter result and its best year so far with an operational EBITDA of €52m.

“Volumes produced in Norway reached the impressive milestone of 405,000 tonnes for the full year following strong growth in sea and consequently good feed demand,” Vindheim said.

Total amount of feed sold reached 523,000 tonnes for the year.