AquaBounty agrees to sell its salmon RAS

United States: The company, as revealed, sold its land-based center for US$ 9.5 million.

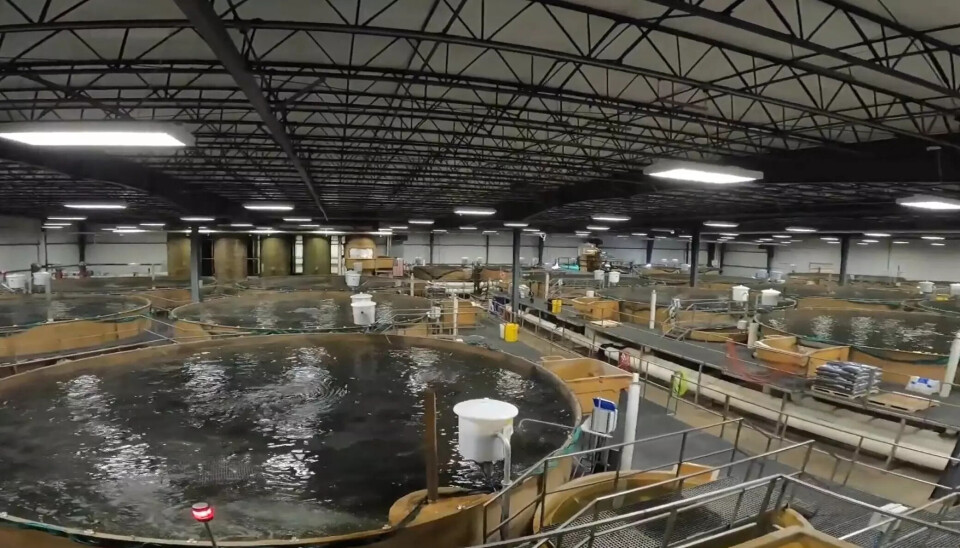

Superior Fresh, a producer of salmon and leafy greens based in Wisconsin, agreed to purchase AquaBounty's land-based salmon center in Albany, Indiana, for US$ 9.5 million, as reported by the company in a market filing last Monday, July 1st.

The deal includes equipment and is subject to customary adjustments, stated AquaBounty, which cultivates the AquAdvantage strain of Atlantic salmon that inherits a genetic modification to grow more quickly.

A portion of the proceeds from the sale is expected to be used to reduce AquaBounty's term loan secured with JMB Capital Partners Lending, the company indicated. The company added that the sale is expected to be completed this month.

Aquaponics

Superior Fresh, located near Northfield, about 160 kilometers east of Minnesota, uses an aquaponics system that utilizes nutrients from its land-based salmon center as fertilizer for salad vegetables grown with their roots in water. The process purifies the water, which can then be returned to the aquariums.

Unlike AquaBounty, the company does not see the advantage of genetic engineering, not even in plants, and states on its website that its fish are fed an organic, GMO-free diet. It emphasizes that its fish contain twice the omega-3 content of other salmon and "are not fed like most farmed fish, which too often are fed with formaldehyde, pesticides, antibiotics, and GMOs".

Goal Achieved

AquaBounty put its Indiana facility up for sale last February, which produces 1,200 tons per year, to raise funds. The company is building a 10,000-ton RAS plant in Pioneer, Ohio, but halted construction last year due to rising costs, which had reached nearly US$485 million - US$495 million.

“The Indiana land-based recirculating aquaculture facility has been growing genetically modified (transgenic) Atlantic salmon from AquaBounty since 2019 and has achieved its goal of demonstrating the company's ability to grow and sell its salmon in the market,” AquaBounty revealed in a press release in February.

Need for liquidity

"Now that the construction of their center in Ohio is 30% complete, the company plans to prioritize the necessary financing alternatives to resume and complete its construction, while the earnings from the sale of their farm in Indiana are expected to provide the necessary liquidity to AquaBounty's balance sheet," the company stated.

In April, AquaBounty obtained a short-term loan of US$10 million from JMB Capital Partners Lending to raise working capital and purchase existing debt and to use as collateral both the Indiana farm and its unfinished RAS facility in Ohio. The loan is due at the end of this month or earlier, after the sale of certain securities or in case of default.

Last month, AquaBounty announced that the company's chairman, David Melbourne, would take on the additional role of CEO, replacing Sylvia Wulf, who continues as the non-executive chairwoman of the company's board.