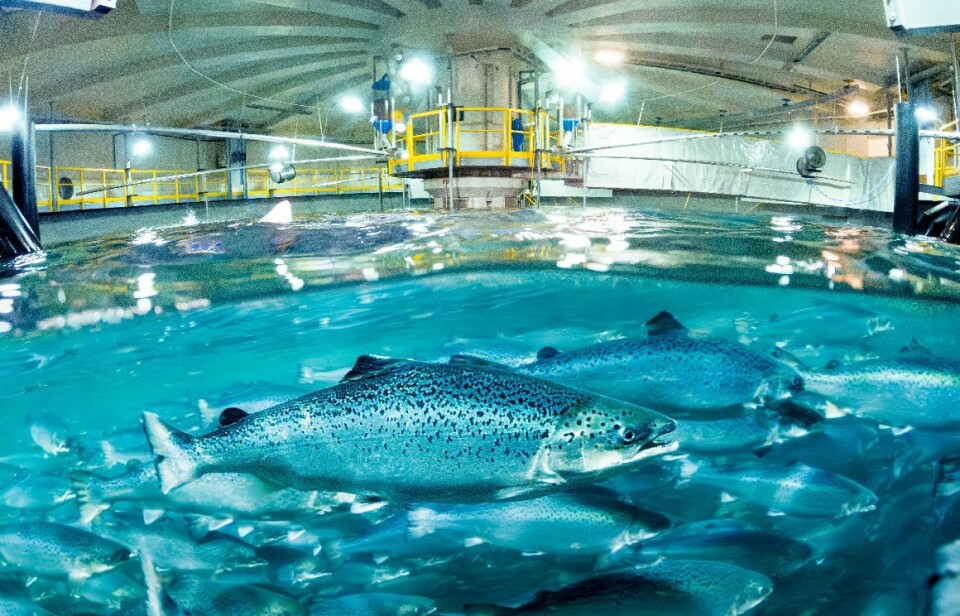

Land-based: the worst is behind us

Financial analyst sees bright future ahead for sector after its learning period

Land-based fish farming has had a bumpy ride but its future is looking good, a Norwegian seafood analyst believes.

“We believe growth within land-based will pick up,” Kristoffer Haugland, of financial services firm Arctic Securities, told the Norwegian edition of LandbasedAQ.

He pointed out that in 2021, production was expected to be 181,000 tonnes in 2025. This has now been adjusted down to around 22,000 tonnes. However, by 2030, the volume could rise to 250,000 tonnes, according to Haugland.

“The projects on the drawing board indicate that we will see significant growth in the coming years,” he said.

Three to watch

Haugland picked out three companies that show the most promise: Salmon Evolution, Andfjord Salmon (both Norway), and Nordic Aqua Partners (China). All three have already produced fish and are in different stages of development.

Salmon Evolution, which uses a hybrid recirculation / flow-through system, harvested regularly last year.

“We believe Salmon Evolution is the best choice, given that the stock is cheap in relation to the deliveries,” said Haugland.

Salmon Evolution is the best choice, given that the stock is cheap in relation to the deliveries

Kristoffer Haugland

The analyst pointed out that the company delivered a relatively good 2024 operationally and financially, despite some challenges with the quality of a couple of smolt stockings, which means that “steady state” for phase 1 of its facility on Indre Harøy is unlikely to be achieved until 2026.

Andfjord Salmon uses a flow-through system and has completed a production cycle as a proof-of-concept, although is not yet in regular production. Nordic Aqua Partners, which uses a recirculating aquaculture system (RAS) facility, started well but recently had to downgrade harvests due to an off-flavour issue.

“Andfjord has built the first four pools in line with budget and schedule, so that smolt releases of ~8,000 tonnes (at harvest) can take place this summer. Nordic Aqua Partners’ first harvest was very promising, with 500 tonnes at an average harvest weight of 4.5 kilograms. They have had challenges with geosmin, but phase 2 is funded, and we believe the company has a lot to go on if they prove that the plant is working in 2025,” said Haugland.

Investors remain cautious

Despite the potential, Haugland believes investors do not seem to be pricing in a large premium on the stock exchange.

“The market shows great appetite for land-based farmed salmon, but investors are more cautious.”

He pointed out that throughout 2024, Salmon Evolution more or less achieved the spot price, while net pen fish farmers struggled with downgrading large quantities of fish as a result of winter wounds and damage from “barbed wire” jellyfish.

“In the first half of the year, they (marine farmers) had to settle for prices that were NOK 15-20/kg below the spot price, so it is obvious that the market has a good appetite for land-based farmed salmon.”

However, he pointed out that investors are more measured, and that most companies are traded at a price that is 10–40% higher than the total capital invested in phase 2 of their projects.

“Since construction began, there has been significant inflation in the type of infrastructure work that has been done at the companies’ locations. This means that the real premium to “replacement cost” is probably closer to zero. Growing pains in some projects may explain some of this, as well as the fact that traditional fish farmers are currently cheaper compared to historical averages,” explained the analyst.

Worst is behind us

Haugland is optimistic about the future of land-based salmon.

“We believe that the worst is behind us, and that the companies have learned from the first phase. There are a number of new projects coming, especially in Iceland towards 2030, with solid backing from people with long experience from the industry. The 250,000 tonnes that may come in 2030 will in any case not constitute more than ~ 5% - 7% of the total supply side, which is already well limited by regulations.”

The analyst described developments in the salmon market as different this year compared to last year.

“Slaughter weights are higher, and the proportion of superior salmon is more or less at the highest levels recorded. This naturally means a lower price for superior salmon, and a smaller difference to production fish.”

Haugland believes this productivity growth will be beneficial for farmers' profitability in 2025.

“They achieve a higher price, while reducing fixed costs per kilogram due to larger slaughter weights,” he concluded.