Land-based salmon farmer enters the post-smolt market

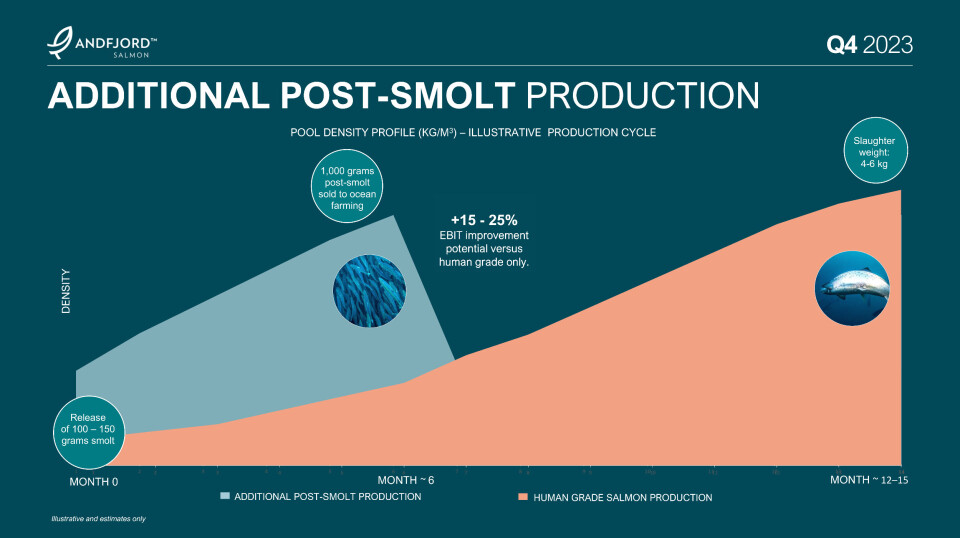

In its Q4 report, the Norwegian company Andfjord Salmon reveals that it will invest in a strategy to produce and sell post-smolt, in addition to its food fish production. It should provide a 10% higher production volume of the biomass in the pools and improve the operating result (EBIT) by 15-25%.

The company summarises a number of main points from the new post-smolt strategy:

- The operating profit (EBIT) increases by approximately 15-25% through a combined production strategy

- Better utilisation of pool capacity enables a 10% higher production volume

- Requires no additional investment in infrastructure

- The company receives income earlier and better cash flow

- Provides positive biological and environmental effects for marine farmers

- Strategic collaboration with Eidsfjord Sjøfarm/Holmøy Havbruk on the production of post-smolts

"We have worked for a long time on the post-smolt strategy and are happy to finally be able to present it. It has positive ripple effects for sea farmers, the fish, the marine ecosystem, the aquaculture industry in the region and Andfjord Salmon. It will be a valuable supplement to our own food fish production, because we make better use of our infrastructure and create value for many stakeholders," says Andfjord Salmon chief executive Martin Rasmussen in a stock exchange announcement that followed the Q4 report.

Martin Rasmussen during presentation of the company's Q4 results today.

The company says there is a high demand for post smolt because it is considered positive to shorten the fish's growth period in the sea.

"Fish that are larger and more robust before being released into the sea can be less susceptible to diseases, have a reduced exposure time to salmon lice, and can achieve higher survival rates," Andfjord points out.

Increases production capacity

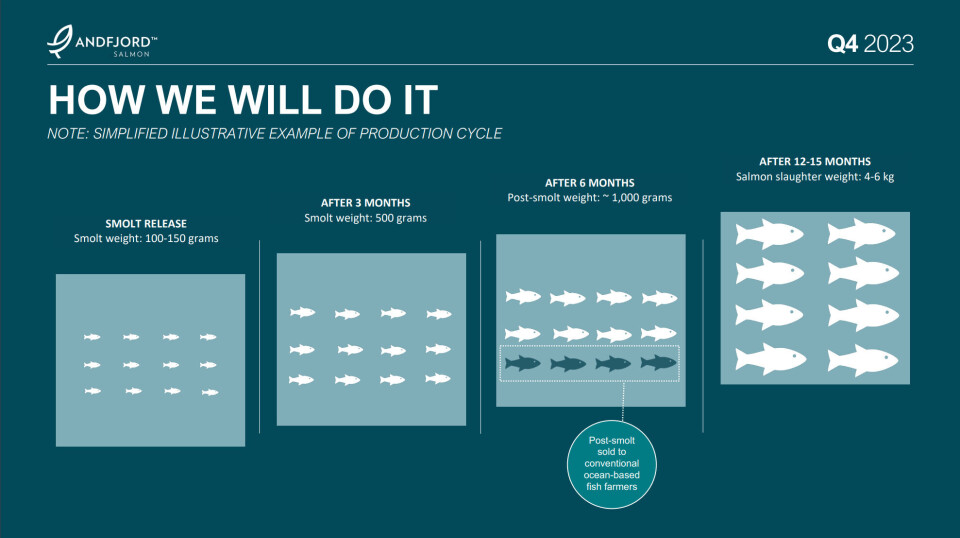

Andfjord Salmon is building 12 large pools at Kvalnes on the island of Andoya in northern Norway, and will have unused capacity in its pools after smolts for food fish production have been stocked. The plan is to use some of this spare capacity to release more smolts.

"When the biomass density reaches a certain level, typically when the fish after 5–7 months weighs around 1 kilo, some of the fish in the pool will be sold as post-smolts to marine farmers in the local environment," Andfjord says.

"In short, we are increasing our production capacity and income potential without having to make new investments in infrastructure," says Rasmussen.

According to Andfjord Salmon's calculations, the strategy will result in a 10% higher production volume of the biomass in the pools. The company estimates that the operating profit (EBIT) will improve by 15–25%. The company's cash flow will also be strengthened as it receives income from the sale of post-smolts after just 5–7 months, in addition to income from the sale of food fish after a production cycle of 12–15 months.

Cooperation with Eidsfjord Sea Farm

Andfjord Salmon has entered into a strategic collaboration with Eidsfjord Sea Farm/Holmøy Fish Farming to deliver post-smolts to the farming company's sea-based cages in the local area from next year. The first production plan for Eidsfjord Sea Farm/Holmøy Fish Farming and Andfjord Salmon has been approved by the Norwegian authorities.

Eidsfjord Sea Farm/Holmøy Fish Farming, which produces around 25,000 tonnes of salmon annually in farms around Nordland and Troms, owns a 4.54% stake in Andfjord Salmon, which is in talks with other local marine farmers about entering into similar collaborations.

"Andfjord Salmon would never have achieved our good biological results if we had not learned from marine farmers and could rely on the collective expertise of the northern Norwegian farming industry. Through this collaboration, we can together raise the environmental, biological and economic development in the farming industry in Vesterålen one more notch," says Rasmussen.

Construction progress

In the current construction phase at Kvalnes, Andøya, Andfjord Salmon will build four new pools, which will increase the company's production capacity to 8,000 tonnes of gutted salmon from 2025.

The company aims to reach a production capacity of 40,000 tonnes at Kvalnes through gradual volume increases between 2025 and 2030. In the first construction phase, Andfjord Salmon is also developing area infrastructure, such as waterways and the port area, which will support a future production capacity of 40,000 tonnes of gutted salmon at Kvalnes.

In January this year, Andfjord Salmon stated that the excavation of the next 12 pool pits at Kvalnes was completed a quarter ahead of the original plan. As a result, preparations have now been started for the production of the first four pools.

"The progress of the other ongoing work streams – port area and inlet and outlet tunnel – is also good," it reports.

When asked during the presentation how it assesses financial risk linked to Norway's upcoming new regulations for the establishment of land-based farming - whether, for example, it could lead to increased investments as a result of requirements for cleaning emissions - Rasmussen replied as follows:

"When it comes to the technical design, we have full flexibility to add whatever we want. But I think it is important to emphasise that we already have a very good model for producing salmon. It is important to look at the map, which shows that we are far away from other breeders and we have a very good recipient, which means that we can co-exist with the existing industry in a very good way."

Financial results

Andfjord Salmon is currently expanding the facility at Kvalnes and therefore had no salmon production or income in the fourth quarter of 2023.

The company had a loss of NOK 19.4 million in the fourth quarter of 2023 compared with a loss of NOK 18.2m in the same period the previous year.